The Power of Price Pack Architecture for Revenue Growth

Over the past two years, "Price Pack Architecture” (PPA) has evolved from a technical term used by revenue managers to a prominent topic featured in financial press headlines and CEO earnings calls.

This trend gained traction after substantial price increases during the phase of high inflation, when companies saw PPA as a way to correct their price position without price decreases if they had increased by too much, or further increase without crossing critical price thresholds. Therefore, the term PPA has become more controversial in the press, with the NY Times calling it a euphemism for shrinkflation.

In a recent poll among revenue growth managers conducted during one of our webinars, 80% of participants stated that PPA is becoming “more” or “much more” relevant for their organizations.

Furthermore, one of the leading CPG companies, pladis, utilizes PPA to increase its revenues.

- Where does this increase in interest in the topic now come from?

- Why do current tools available to professionals fail to provide the best insights into how to optimize PPA?

- How can recent developments in AI be used to better steer PPA?

In this blog, we will address these three questions.

Why Traditional Approaches To Understand PPA Fail

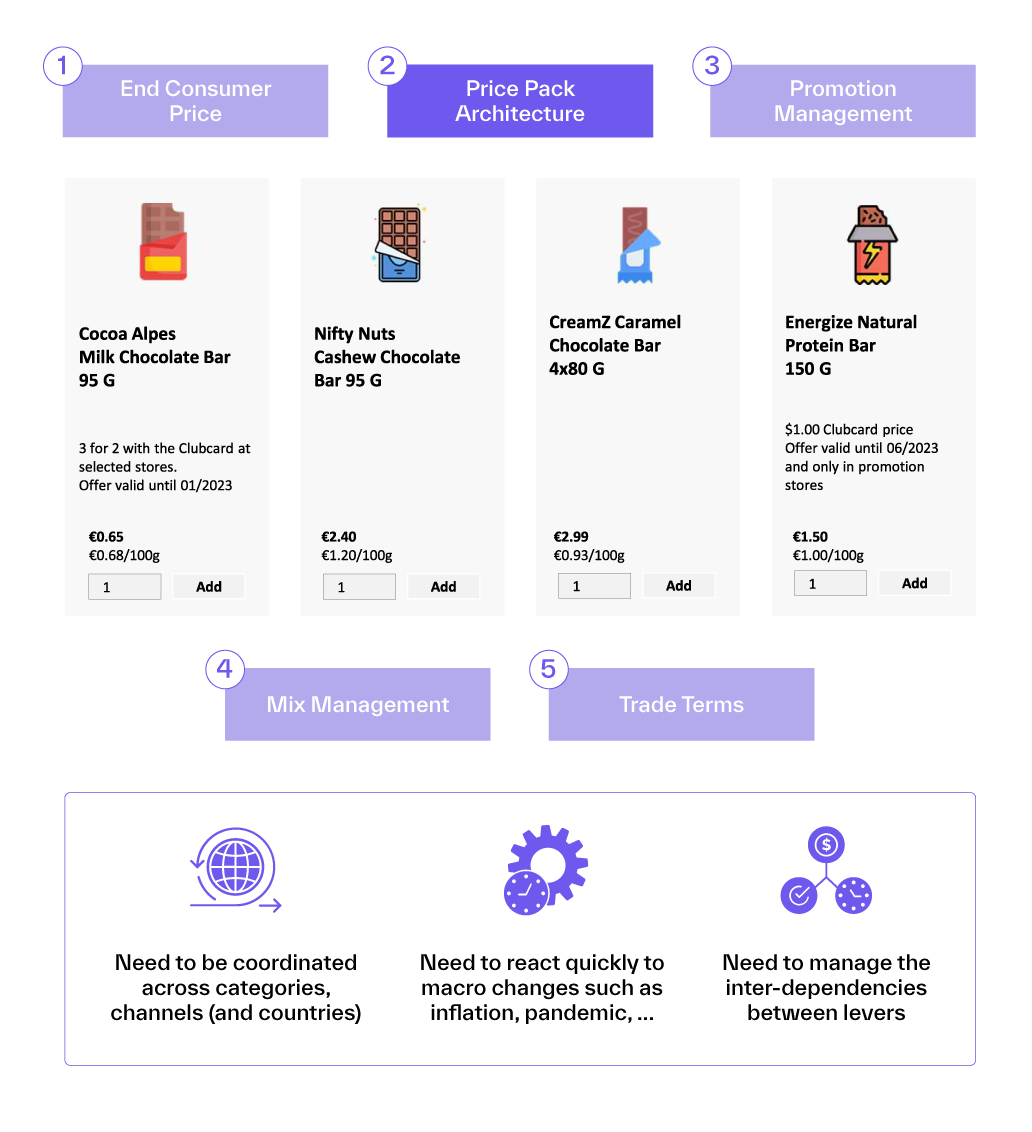

Revenue Growth Management (RGM) is a strategic approach that aims to optimize a company's (net) revenue and profit potential by optimizing pricing, promotions, PPA, trade spend, and distribution mix. In the past two decades, RGM functions have been created within many commercial organizations to holistically address previously scattered functions across marketing, sales, finance, and other departments. RGM aims to drive sustainable and profitable growth by leveraging data-driven insights and aligning various business functions to make informed decisions.

As one of the key levers, Price Pack Architecture refers to the structuring and design of product portfolios with a specific focus on price points, packaging sizes, and configurations. This concept is particularly relevant for consumer goods, where products are often sold in various sizes and formats to meet different consumer needs and preferences. Here, it is an important challenge within RGM to coordinate PPA with the over levers, including price change, promotions, and trade spend.

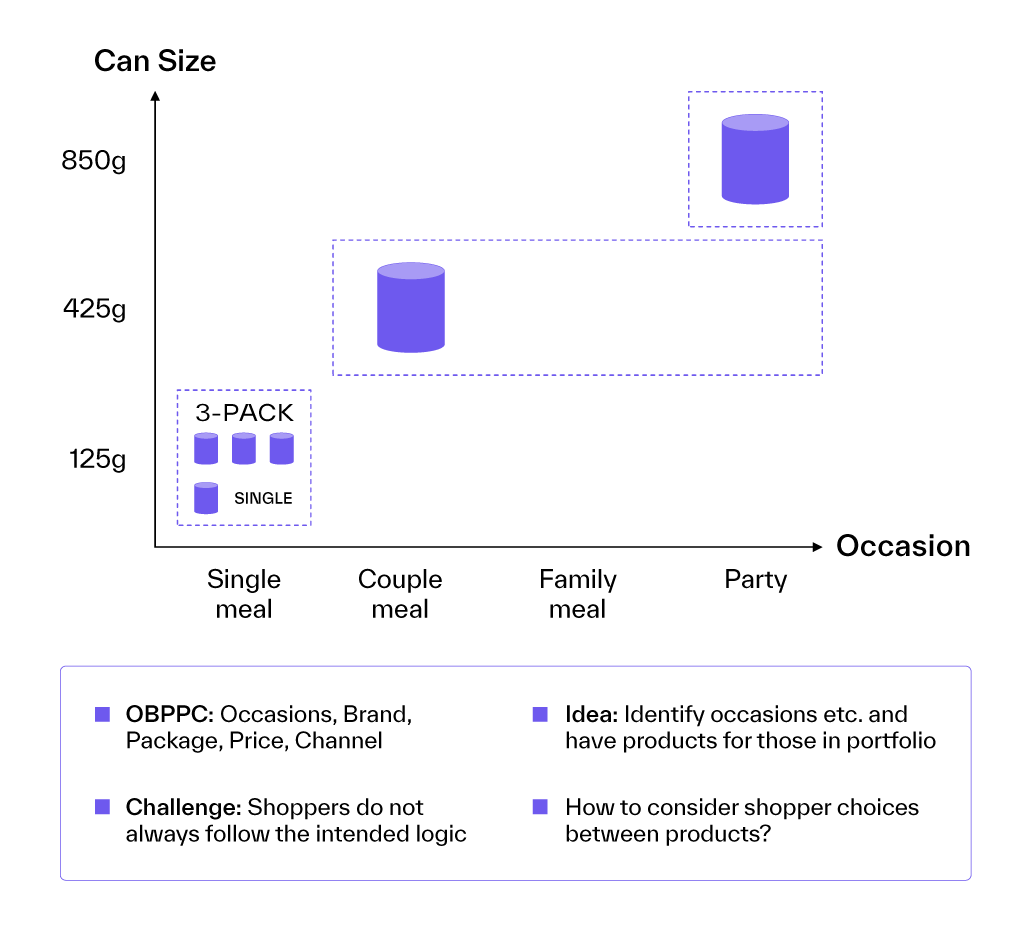

A set of heuristics and narratives have evolved over time to support PPA decision-making. One of these is the OBPPC framework, which suggests focusing on the following five questions to determine the PPA by channel:

- Occasions - when does the shopper choose which products?

- Brand value - what is the brand segment based on the product portfolio?

- Package size - what size should be offered for what occasion and brand?

- Price - what price should be set after considering all of the above?

- Channels - where can the products be sold based on the above?

When we apply this framework to identify the right can sizes for canned corn, the narrative can go like this:

On different occasions, shoppers need different amounts of corn, ranging from single and family meals to parties. Together with the brand preferences of these different segments, the brand can determine what pack sizes they should offer. Then, they must choose the right price for each product variant in the portfolio. Throughout this process, if the answers to these questions differ significantly between channels, then the PPA should be differentiated—for example, by not offering all sizes in each channel.

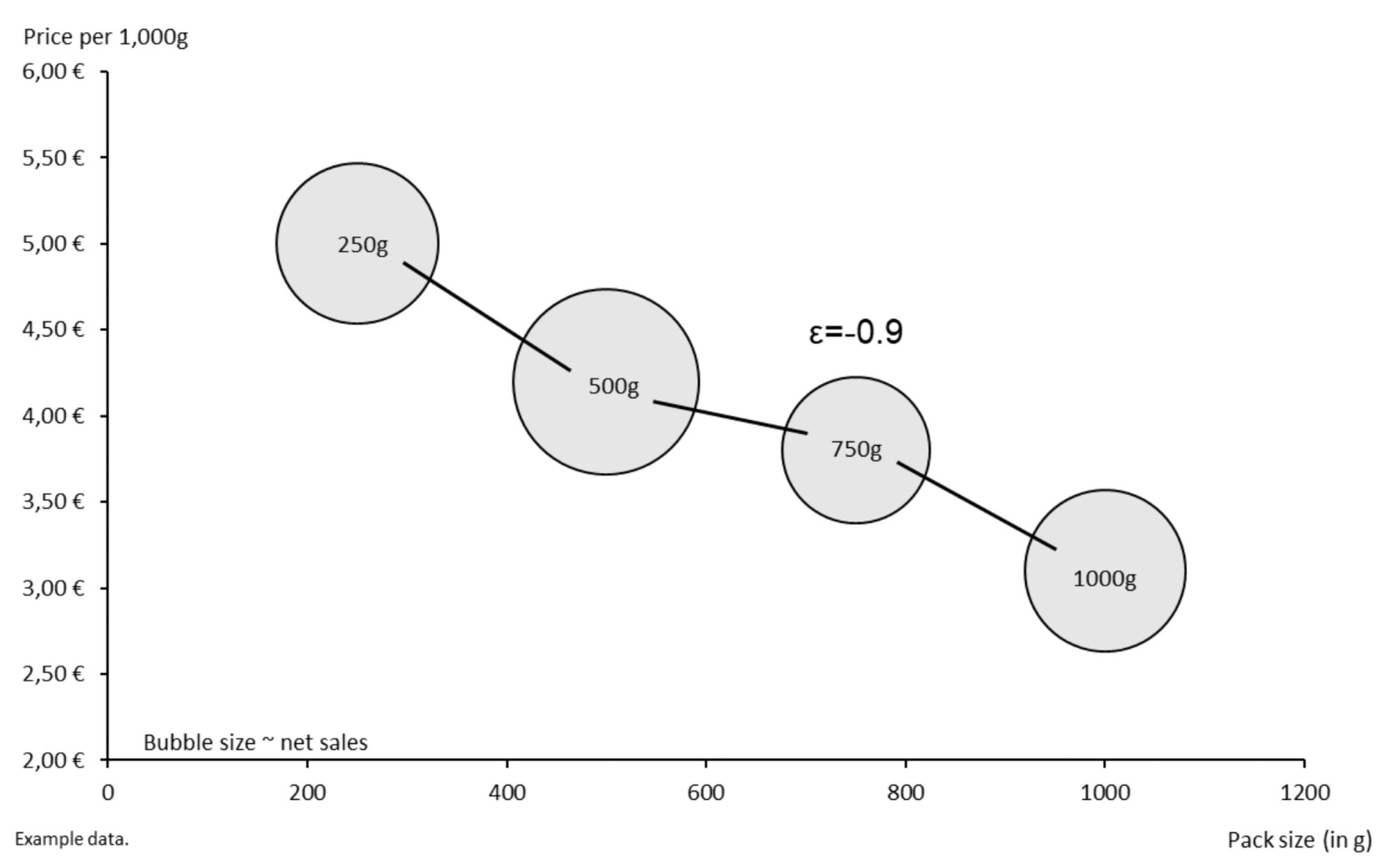

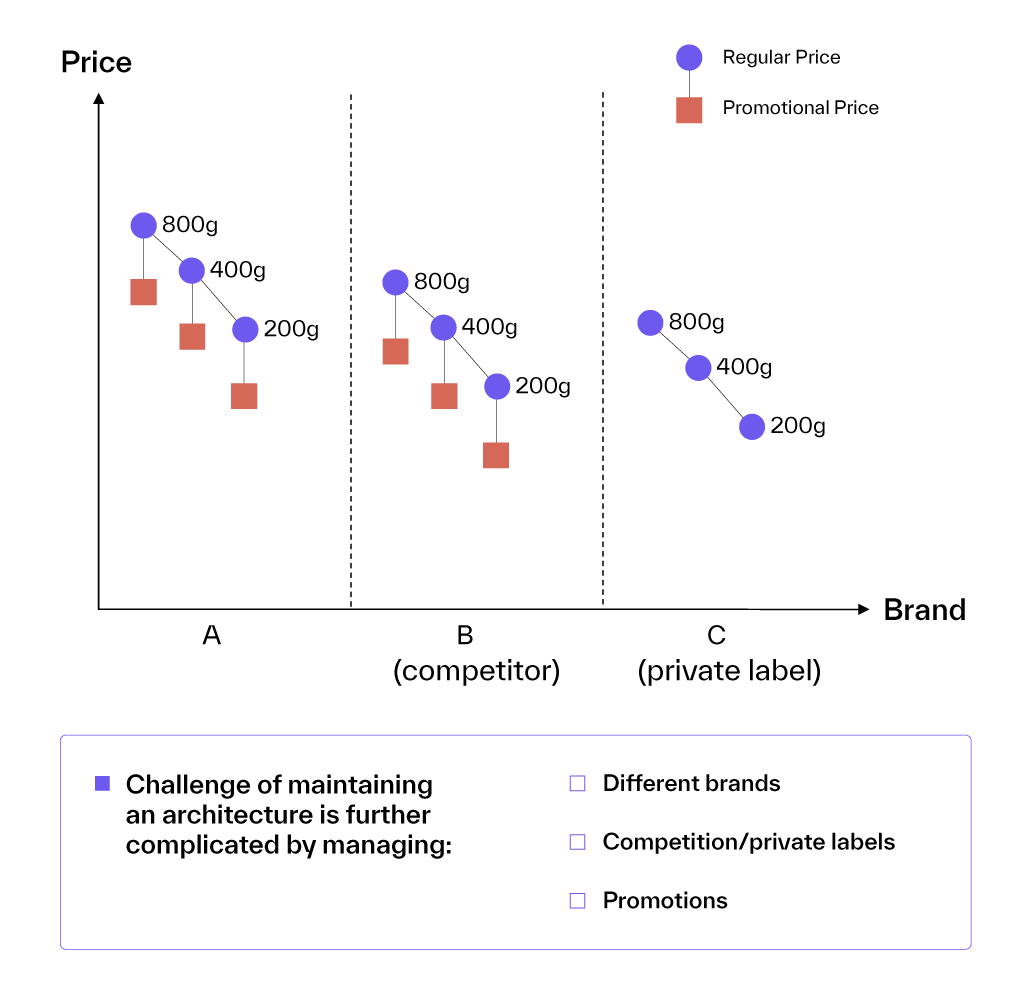

Most tools aim to manage consistency within the portfolio when determining the prices for the different pack sizes. For example, a common approach is to apply a decreasing price per weight with increasing pack sizes. This is most accepted by shoppers, as it aligns with their expectations and internal costs.

Further, professionals also look for price consistency against their brand competitors and private labels—both for regular and promoted prices.

While such heuristics provide a rough orientation for setting up a portfolio, they are unsuitable for precise portfolio optimization. For example, the consistency-focused price-setting mechanisms outlined above do not coordinate well with other pricing tools, such as price elasticity. If the competitor position suggests a price decrease and the price elasticity indicates a potential price increase, what should the pricing manager do?

Most of all, the core problem with the OBPPC framework is that it looks at the portfolio from a manufacturer’s point of view and not from the perspective of the shopper. The shopper looks at the different products on the shelf and decides based on their preferences—and while they are single, they might still buy a 425g can of corn. For example, they plan to consume the can over two days because the price difference is not too large.

The key point here is that understanding the sales dynamics and how PPA, together with pricing and the other RGM levers, affects sales, (net) revenue, and profit is more complex than captured by the traditional heuristic predominantly used today.

Therefore, RGM professionals need a solution that helps them understand how all the different RGM levers interact and affect sales, (net) revenue, and profit. Key example questions that professionals must answer are:

- How does adding or removing a product from a portfolio affect the sales of other products in your portfolio—and the sales of your competition?

- How many sales move between two products in a portfolio if the price difference between them increases or decreases?

- How does a promotion affect the unpromoted products in the portfolio?

- How do PPA changes affect a brand's market share?

Next Generation of PPA Using AI

Today, AI-driven strategies redefine RGM, ensuring data-driven, customer-centric decisions that enhance net revenues and profit margins. To address PPA changes holistically alongside other RGM levers, Buynomics introduced the Virtual Shoppers AI technology.

This innovative technology simulates large groups of virtual shoppers who make purchasing decisions just like real shoppers. The system generates hundreds of thousands, or even millions, of virtual shoppers, each with unique preferences for different brands, product sizes, and other attributes. These virtual shoppers also exhibit various behavioral traits, such as their reactions to price thresholds, promotions, or store placements. All virtual shoppers make individual buying decisions based on these characteristics and the available offers.

Buynomics' Virtual Shoppers AI technology integrates the assessment of all data sources, RGM levers, and product changes (considering cross-effects). Specifically, the technology tracks how virtual shoppers switch between products after a PPA change—for example, the introduction, removal, or change of a pack size. This allows users to assess the precise effects of their actions on their entire portfolio (see the short demo video below).

Using the Buynomics platform powered by the Virtual Shoppers AI, our customers benefit from the following tangible results (depending on data quality):

- Substantially more precise forecasts with up to 95% accuracy,

- Higher speed to insight, producing results in minutes, not weeks, and

- More profitable decisions with up to 2-4% higher gross profits through better offers.

Inflation and rising supply costs create significant challenges for CPG companies striving to achieve revenue goals without lowering prices.

Price adjustments can sometimes negatively impact an entire category. One leading CPG company, pladis, addressed this issue using the Buynomics platform. It enabled them to fully understand the impact of price changes on their key metrics and overall revenue. Additionally, they are able to model changes in product sizes.

Watch the full pladis experience with Buynomics here.

For pladis and many other CPG companies, adjusting product sizes rather than prices has proven to be an effective strategy to remain competitive and meet revenue targets.

Get Started Today to Reach Your Goals Tomorrow

Request a demo today to see how Buynomics supports your RGM team and helps you make data-driven decisions.

August 01, 2024

.png?width=100&height=100&name=Cart%20(1).png)