The History and Future of Revenue Growth Management

These are challenging times in the CPG world. Disruptive forces like rising inflation, regulatory changes, exogenous shocks, and changing customer behavior continue to shake up the industry.

These changes expose serious gaps in Revenue Growth Management (RGM) and force companies to rethink their RGM and innovation strategy.

Eighty percent of businesses remain dissatisfied with their Revenue Growth Management despite years of resource-intense investments in their initiatives. Executives can turn the tide by introspectively examining their company's RGM past, present, and future and leveraging that knowledge to create and maintain sustainable competitive advantage.

Read on to learn more about RGM's history, current impact, and potential future trends.

Revenue Growth Management: A Historical Perspective

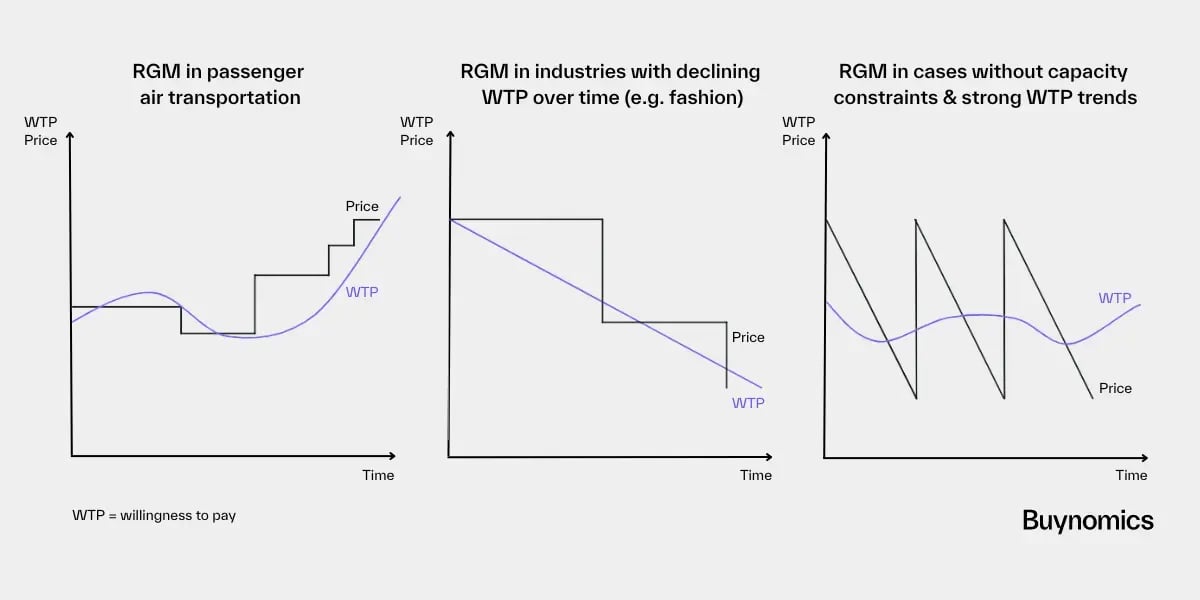

The earliest description of forecasting models, the predecessors of modern Revenue Growth Management, can be found in passenger bookings and cancellation models of the airline industry roughly 50 years ago.

The industry focused on occupancy optimization—avoiding cancellations, no-shows, and misconnections—until Littlewood’s Rule in 1972, when airlines used data to forecast load factors based on advanced bookings.

Technological developments, such as a sophisticated computer reservation system, created opportunities to develop an algorithm to maximize revenue.

Littlewood’s algorithm enabled a forecasting system based on a seat inventory problem for a single leg with two fare classes. Years later, yield management, which is closely related to RGM, came into existence on a significant scale after the deregulation of the U.S. airline industry. American Airlines (A.A.) and PEOPLExpress fought for the lowest fares, completely transforming the industry.

Yield management is a variable pricing strategy based on understanding, anticipating, and influencing customer behavior to maximize revenue or profits from a fixed, time-limited resource (e.g., seats in an airplane or hotel rooms). In the end, A.A. managed to control the availability of deeply discounted seats for the first time, forcing their competitor into irrelevance.

Based on the airline industry’s yield management, the hotel industry applied RGM strategies in the late 1980s. At this time, the products shared similar characteristics, such as perishability, fixed capacity, and the need for segmentation based on customers’ levels of price sensitivity.

RGM is essential for hotels as it’s a service, not just a product on the shelf. Demand varies by day of the week and season, and hoteliers can attach or package many services to a simple room night to capture the interest of many customers.

Although challenges in the CPG industry are more complex than in the hospitality or aviation sectors, the idea of using advanced analytics to predict customer behavior became crucial for the survival of CPG companies. CPGs must focus on “Profit Management”—employing top-line growth to drive revenue and profitability.

Since 2017, over 60% of revenue growth in the world’s top 50 FMCGs emerged from optimizing pricing, product mix, and promotion management—not from volume increases. With retailers' increasing power and the industry's aforementioned external and internal challenges, successfully executed RGM will be crucial for businesses' survival in the next decades.

Revenue Growth Management Today

Today, Revenue Growth Management's scope and influence go beyond the hotel and airline industry. CPGs use advanced analytical tools like machine learning or artificial intelligence to predict customer behavior and optimize pricing, portfolios, product development, and promotion planning.

RGM strategies evolved from the traditional periodic assessment. In the last decades, the CPG industry invented new processes and tools that seemingly revolutionized profit optimization and revenue growth. Companies were able to respond faster to changes in customer behavior and strengthened their position facing the rising power of intermediaries and retailers.

However, the operation landscape is shifting faster than expected, and internal and external factors expose big problems in outdated RGM programs. Processes are not sufficient, silos in the organizations lead to inefficiencies, and legacy tools are simply inaccurate and lead to unnecessarily high costs. The revenue managers of tomorrow must reimagine their tactics and strategies to cope with today’s challenges effectively.

One of the key issues for CPG companies today is broken links between real-time data collection and insight execution. These links result in ineffective spending and low returns on investment.

CPG brands spend between 11% and 27% of revenue on trade promotion, the second-largest expense on the profit and loss table. Yet 72% of all trade promotions in North America lose money. The same problem can be seen in pricing decisions, which often rely on legacy tools like elasticities or outdated heuristics like value-based or cost-plus pricing.

Companies need to consider new external factors at this time. Rising inflation rates lead to massive spikes in commodity prices. In February 2022, the U.S. experienced the highest year-on-year leap in inflation rates at 7.9%. Rebounding customer demand with disrupted global supply chains increases the burden.

Legacy RGM strategies cannot keep pace with rapidly changing industry standards. They no longer ensure the creation of sustainable competitive advantage, and CPG brands must, therefore, rethink their strategies completely.

The Future of Revenue Management

The ever-shifting dynamics of an inflationary market warrant the innovation of Revenue Growth Management systems. CPGs must know the following trends and innovations to remain profitable in the coming years.

Building a Multi-Channel Approach

Traditional Revenue Growth Management strategies are tactical-based, focusing on pricing and inventory controls. Brands need to adopt a holistic enterprise approach to their revenue growth targets.

Strategic RGM solutions rely on insights from sophisticated data analysis while simultaneously building the capabilities to transform these insights into action. Take advantage of the shifts in consumer behavior and commodity pricing.

Now is the perfect time to comprehensively review your RGM. Use innovative advanced analytics tools to assess your firm’s channels, customers, and competitors. Stop relying on legacy tools and plan your actions with evidence-based insights.

Leveraging AI

Revenue Growth Management strategies need to result in actions taken by shoppers. Real-time insights are an integral part of the equation. They allow businesses to tailor products fast to match changing market dynamics.

Legacy models like value-based pricing rely on gut feeling and heuristics and do not serve customers' demands today. Using sophisticated analytical tools and systems, like Buynomics' Virtual Shopper AI, can drive top-line growth and record a better return on investment.

Automation and innovative tools enable businesses to achieve long-term profitability, support trade-term negotiations, plan and execute data-driven promotion, and develop customer-centric products. About 43% of CPG brands target Artificial Intelligence and Machine Learning as priority investments.

Mending the Loopholes with Cloud Technology

The lag between data analysis and executed insights is the leading cause of Revenue Growth Management failure. Siloed legacy analytics only provides rear-view insights. The flawed data cannot match the demands of the ever-changing RGM landscape.

Cloud technology can create a closed-loop, holistic approach to data-driven decision-making. Cloud-based solutions offer infinite computing power, high scaling capabilities, and the complete integration of insights, enabling a holistic view of RGM and sustainable competitive advantage.

Transitioning from Data and Insights to Action

The problem is not a shortage of data. CPG brands generate mountains of data and insights about sales, customers, and products while primary and secondary sources increase. Yet 70% of the SKUs developed deliver less than 5% of total revenues.

Therefore, CPGs are moving away from sifting terabytes of data and distilling fast, actionable insights to make conclusions and set them up for immediate action and implementation. With the support of cloud-based systems, CPGs can achieve rapid time to value, and quick decision-making allows them to remain competitive in a cutthroat market.

Conclusion

Revenue Growth Management emerged in a world of high fixed costs and regulatory innovation. Still, it has transformed into the most relevant mechanism for maintaining profitability for CPG companies in the 21st century.

Shifting consumer behavior and an inflationary environment render most outdated systems useless and confront businesses needing innovative tools and processes. To retain a sustainable competitive advantage, CPGs must rethink their approach to RGM and find a way to integrate real-time insights into profitable actions.

Look out for the trends above to set up your brand for consistent growth through an optimized RGM strategy. Redefine your pricing, product development, and insights with deep analytics.

Remember to watch our on-demand webinar for even more insights into RGM's history and future!

Get Started Today to Reach Your Goals Tomorrow

Buynomics is a cloud-based RGM solution that enables you to leverage your real-time data to create actionable insights in minutes. Our Virtual Shopper AI is based on a proprietary machine-learning algorithm, allowing you to understand and predict your customers in a completely novel way that opens up new possibilities for price, product, portfolio, and promotion optimization.

Request a free consultation today to see how Buynomics can support your RGM team and help you make data-driven decisions.

November 21, 2022