How to Master Odd-Even Pricing

Minor distinctions in your pricing strategy can majorly impact your consumers’ value perceptions.

In this post, we’ll explore the concept of odd-even pricing and its psychological grip on shoppers.

- What is odd-even pricing?

- Does odd-even pricing work?

- How to master odd-even pricing

- What companies use odd-even pricing?

- Should you use odd-even pricing?

What is odd-even pricing?

Odd-even pricing is a popular psychological marketing technique that involves pricing items with an odd or even ending, such as $0.99 or $1.00. Depending on the commodity and clientele, consumers perceive certain price endings as more attractive.

The impact of odd-even pricing significantly differs across industries and sales channels. Typically, the more visible a price is, i.e., in e-commerce, the higher the impact of meaningful odd-even pricing strategies. On the other hand, the more purchasing alternatives (substitutes) available, the less relevant odd-even pricing becomes as rationality in purchasing decisions usually increases.

Odd pricing

For example, an odd price ending conveys the impression of a discounted price. Consumers tend to pay attention to the first digit of a price, so reducing a product from $3.00 to $2.99 will be perceived as a value and lead to 10% to 30% higher sales.

Odd pricing also gives the illusion that the price is honest since the number is so specific, such as a 9 or a 5.

Even pricing

An even price ending gives the exact opposite impression of an odd price. Prices ending in 0, such as $100, denote accuracy, simplicity, and, often, premium.

This strategy is often used by luxury fashion and lifestyle brands, which don’t need discounted prices to make a sale. Their clientele is more likely to pay full price and respond positively to even price endings.

Does odd-even pricing work?

Simply put, yes. Psychologists suggest three main reasons why the odd-even pricing phenomenon is so well-received: the left-digit effect [1], the image effect [2], and the perceived gain effect [3].

The left-digit effect makes consumers place more importance on the left-most figure of a price, followed by the second, and so on. As consumers read prices (in the Arabic number format) from left to right, they naturally take in the left-most figure first.

Consider a discounted price of $1.79 from a standard price of $1.93 versus a discounted price of $1.75 from a standard price of $1.89. Both price reductions are equal in their absolute value (-$0.14), but the first sale offer will have a greater impact.

This is because the digit changes by 2 units (9 to 7) in the first offer, whereas in the second offer, it only changes by 1 unit (8 to 7). Since consumers focus on the first changing digit from the left, the first offer seems more attractive.

The image effect leads consumers to perceive an offer with odd prices as a great deal, and items with even prices are more premium, despite no such statement being made.

The psychological reason for the association is that consumers have become conditioned to odd prices when goods are discounted or promoted and even prices for expensive, luxurious items. Therefore, prices ending in 9 are associated with an unbeatably low price, and those ending in 0 cater to those who seek high-end goods.

The perceived gain effect results from consumers rating a difference in prices illogically higher than their actual value.

When evaluating a given price, consumers will perceive gain if the purchase price (price promotion), e.g., $2.99, is lower than the closest round price (reference price), $3.00 in this case. Though extremely minimal, the difference between the odd and the round price is perceived as a gain.

How to master odd-even pricing

Odd-even pricing is useful, but it needs to be applied correctly. Many companies use both strategies to distinguish high-end offerings from lower-end, sale, or clearance items. It's a good option for large brands that offer a variety of products and need to appeal to different types of consumers with varying budgets and interests.

Research suggests that the most effective price ending for odd pricing is “99,” referring to the differences in sales volumes when the same product was priced at $3.00, $2.99, and $2.88. But knowing the setting is crucial to mastering odd pricing; the 99 price effect [4] does not always work, depending on the type of item or good.

While consumers prefer a 99-ending for low-priced items over a cheaper 95-ending, this expectation changes for high-priced items.

For example, a pizza priced at $4.99 will generate higher sales than if it were advertised at the lower price of $4.95. However, if a food processor is priced at $59.99, the sales volume will be lower than if it were advertised at $59.95.

In this case, a 99-price ending would damage the consumer perception of the product’s quality. This opposing effect becomes even stronger for higher 3- or 4-digit prices.

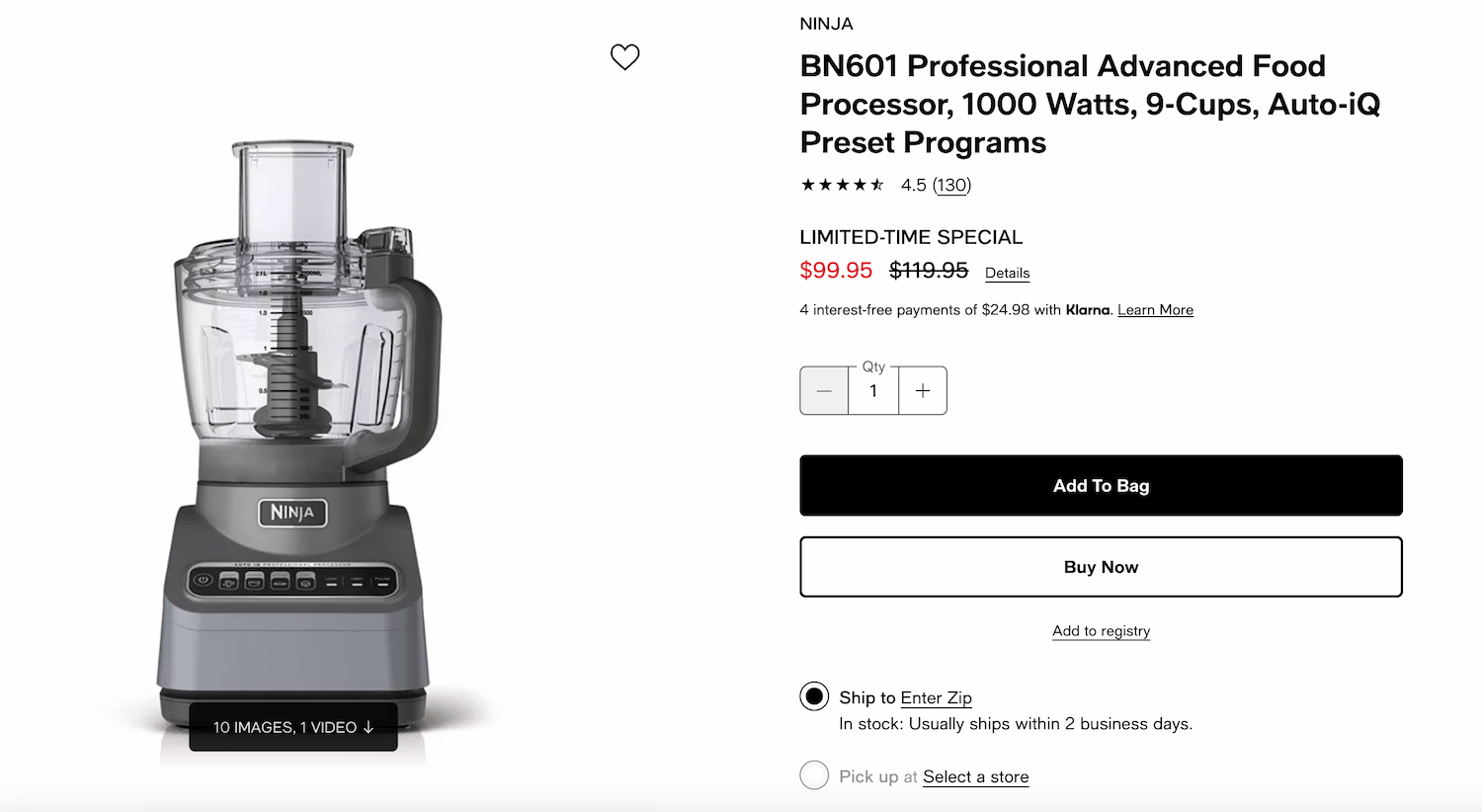

High-end food processor brand Ninja uses .95 price endings on all its discount items.

Applying an even pricing strategy to your new items to bring attention to your new product(s) and boost brand perception. This approach applies to both discount and luxury retailers.

You simultaneously promote other currently discounted items by pricing newer items with an even price ending. Consumers may need to snag older, cheaper items before replacing them with the new collection.

What companies use odd-even pricing?

Odd-even pricing works differently across retailers, consumer types, and more. In B2B, for example, customers with an engineering background often dislike “marketing” prices that end with .99 and prefer prices that appear random (e.g., ending with .87) because they appear to come from some calculated mark-up logic.

Here are three modern examples of odd-even pricing cleverly used by popular manufacturers in different industries:

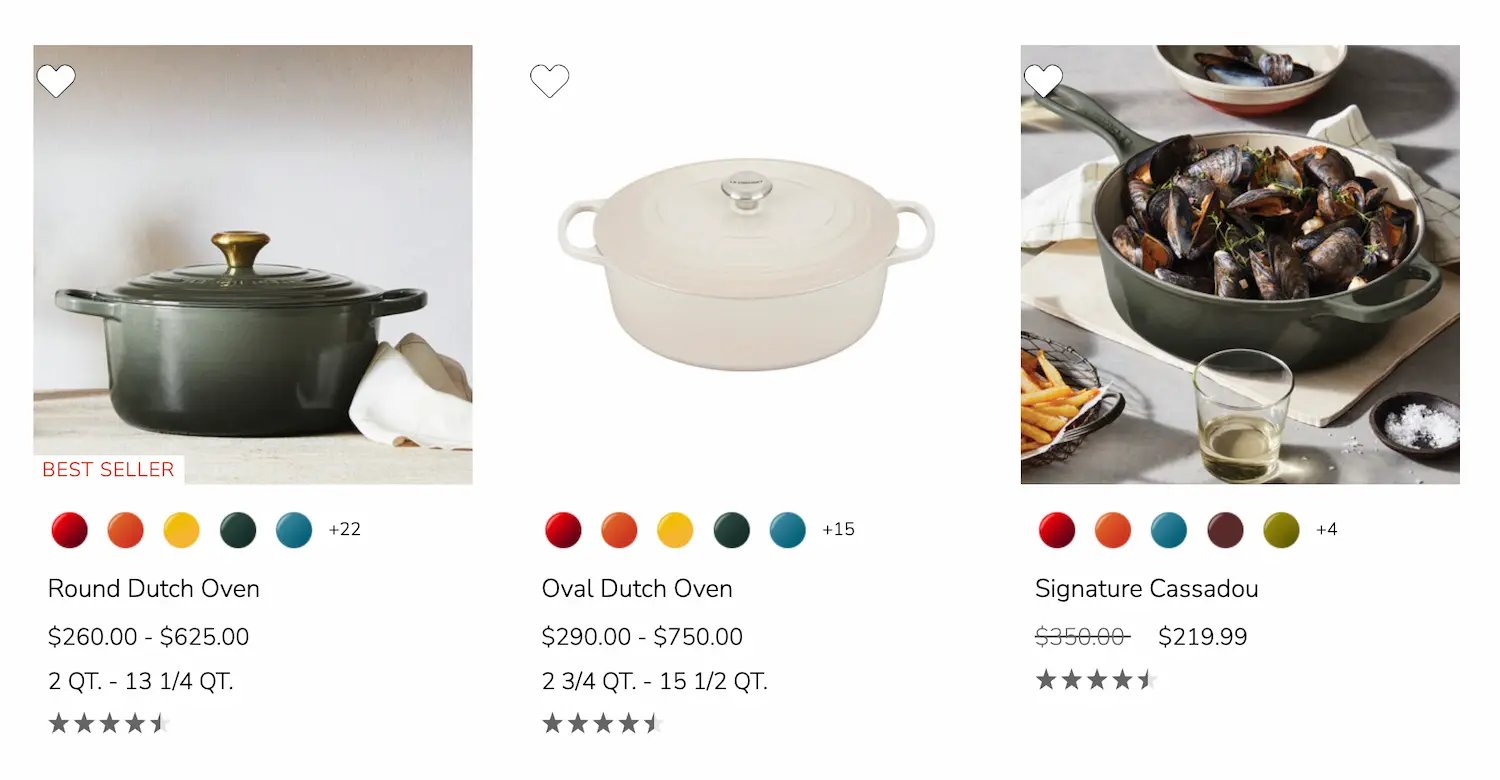

1. Even pricing: Le Creuset

Le Creuset, a company known and respected for its high-quality cook and bakeware, is a luxury brand that uses odd-even pricing to its full advantage.

Take a look at these Dutch ovens: The bestseller Round Dutch Oven and the classic Oval Dutch Oven end with a decimal of .00, whereas a sale item ends in .99.

New and non-sale items always end in .00, allowing room for various odd price endings when discounted. This shows that their items are high-end but marketed to discount shoppers.

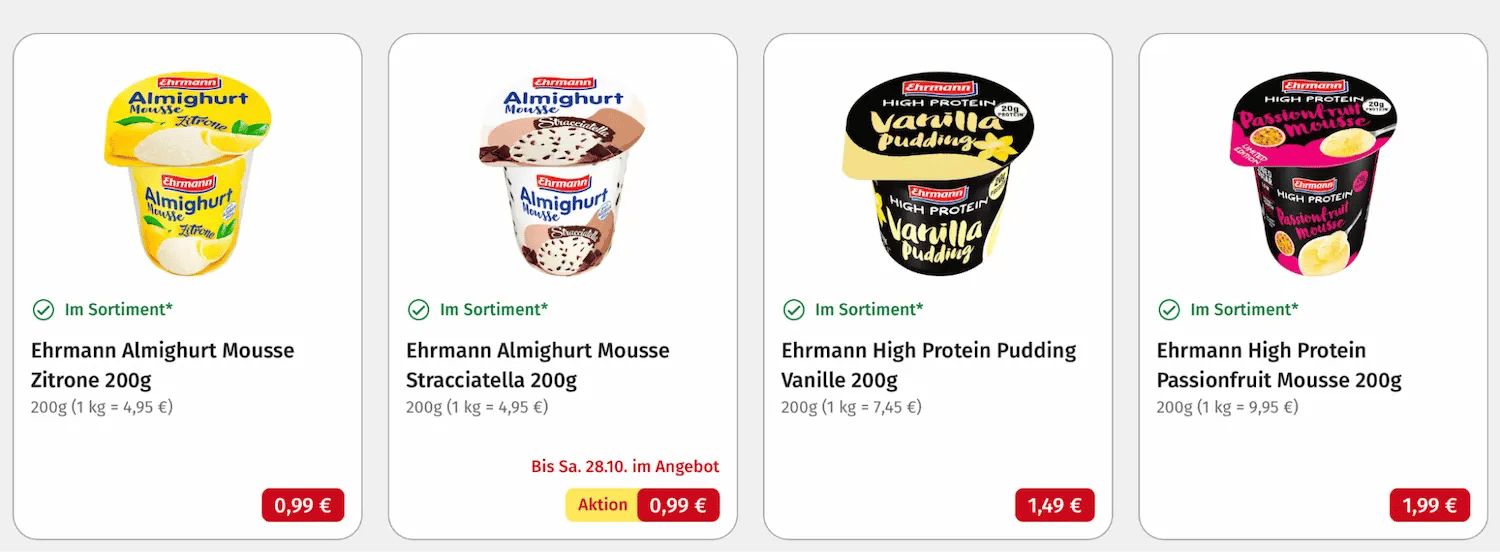

2. Odd pricing: Ehrmann

With an attractive assortment for a broad range of consumers, dairy producer Ehrmann uses odd-even pricing across its portfolio. It focuses on specific price thresholds, taking full advantage of the left-digit effect.

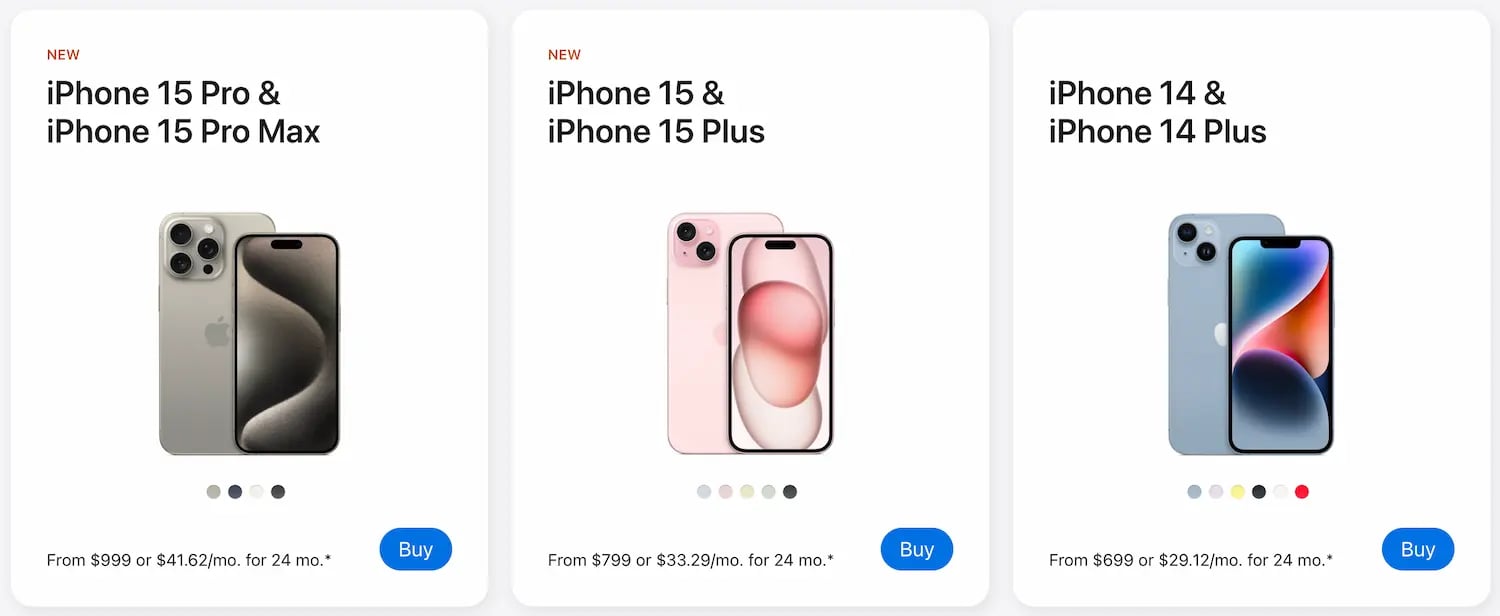

3. Wild card: Apple

Even though there is a general perception of odd and even being discount and premium, this doesn’t always hold true. Technology giant Apple offers premium products but still uses odd pricing.

With new iPhone models, for example, Apple often uses the 99 price effect, with starting prices of $999 or $1,099.

Should you use odd-even pricing?

In theory, businesses understand odd-even pricing and its positive psychological impact. In practice, making the best use of it is difficult, particularly when optimizing a product portfolio.

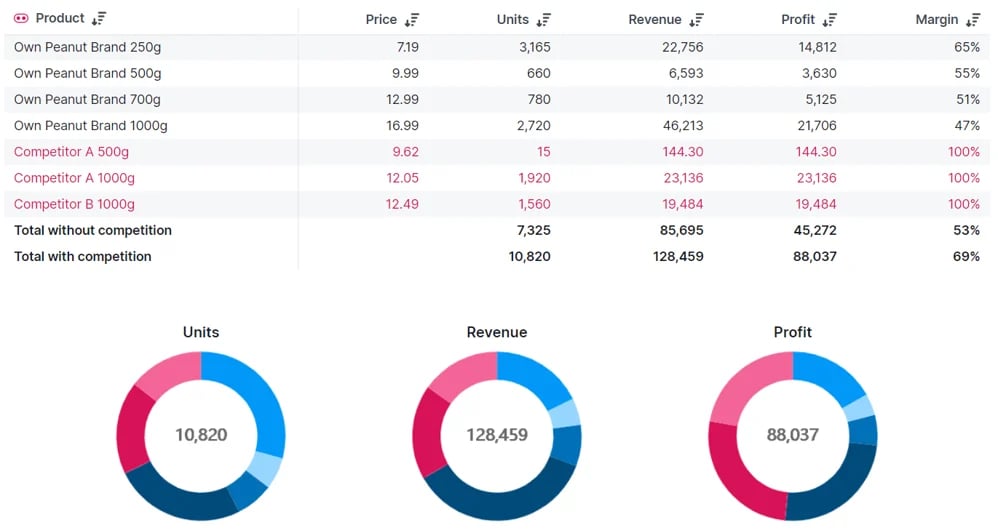

Buynomics’ AI-driven pricing solution lets you simulate how odd–even prices affect your sales and how to best use them.

Our Virtual Shopper AI leverages readily available data and artificial intelligence (AI) to accurately model your shoppers' buying behavior.

These Virtual Shoppers have the same product preferences and behaviors as their real-life counterparts. When they are shown real product offers using the odd-even pricing effect, the Virtual Shoppers accurately replicate your customers' buying decisions.

Get started today to see how Buynomics and its cost- and time-saving features would benefit your business's Revenue Growth Management (RGM) decision-making.

Resources

November 03, 2023

.png?width=520&height=294&name=Website%20Blog%20Featured%20Images%20(9).png)