How Machine Learning Helps PEs Optimize Their Pricing

Any private equity (PE) firm aims to provide a return to its investors by acquiring companies and profitably exiting them after the holding period.

While most PE firms seek to create value through cost optimization, efficiency improvements, financial engineering, or talent upgrades, only a few are skilled at effectively implementing pricing strategies to enhance the value of their portfolio companies.

However, optimized pricing initiatives can generate tremendous value for both the portfolio company and the PE owner. This is particularly true in software deals, where EBITDA growth significantly enhances value.

Current pricing challenges in private equity

PE firms are highly skilled at increasing the value of their portfolio companies through cost optimization, efficiency improvements, or talent upgrades. However, little emphasis is placed on driving returns through effective pricing strategies.

According to a McKinsey survey, the most common reasons for PE investors to shy away from implementing new pricing strategies are the fear that competitors might react aggressively to price changes or that customers will turn away from the company if prices increase.

In addition to these uncertainties, many PE firms lack appropriate tools and commercial capabilities. For instance, only 6% of PE professionals from the same survey feel “very prepared” for pricing challenges regarding tools, processes, and capabilities. Despite this, 40% believe pricing is a top driver of earnings expansion.

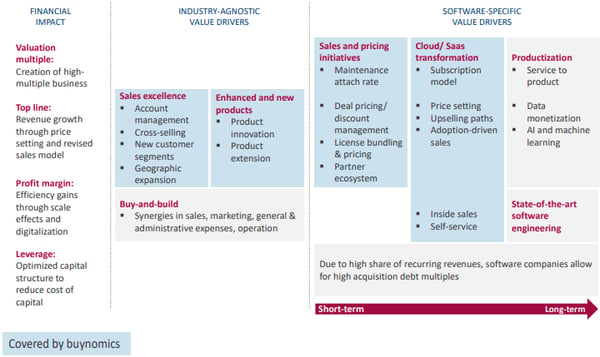

Figure 1: Buynomics can cover several value levers in PE software deals

How Buynomics creates value for PE software deals

-

Buynomics helps to set effective sales and pricing initiatives.

With Buynomics, an unlimited number of price-product combinations can be tested using the Virtual Shopper AI. The effects on unit sales, revenue, and profit are immediately transparent. Each iteration takes only five minutes to conduct, allowing PE firms to thoroughly test different pricing strategies in real time and without risk. This enables executives to grow sales profitably.

-

Buynomics optimizes the product portfolio.

Buynomics lets users dynamically select and add product features and variations. With just a few clicks, new products can be created and immediately shown to the Virtual Shoppers to assess market reactions. This provides an accurate forecast of how real shoppers might react to the new portfolio changes. Product testing has never been easier and less risky.

-

Buynomics supports pricing model transformation.

When transforming from traditional product distribution to Software-as-a-Service (SaaS) subscription, questions about the new services' products, bundles, and pricing need to be answered. Buynomics can help by testing all possible price and product combinations. Private equity funds can easily choose the price and product combination that promises the greatest success.

Conclusion

Every PE investor aims to increase the value of the portfolio companies. However, the potential of improved pricing and product initiatives as a value enhancement method is often ignored.

Most private equity investors lack the necessary tools and knowledge, leading to potential returns being left on the table. Particularly in software deals, price and product initiatives can have a high impact on a company’s valuation.

Buynomics creates actual value for PE firms’ portfolio companies. PE managers can test price and product strategies with a sample of Virtual Shoppers that behave just like consumers in the real world. Testing a new scenario takes only a few minutes, and after each iteration, the effects on profit and revenue are instantly visible.

As such, Buynomics has so far contributed to a 20% increase in profits for a major software provider and delivered 70% additional profits on promotions for a large telco firm.

Lastly, competitor moves can be easily integrated into the analysis as well. Thanks to its unique capabilities, Buynomics helps its customers reach their KPIs and avoid unwanted effects. With its predictive accuracy of >95%, you can be confident to launch campaigns that create sustainable competitive advantage for your businesses.

Get Started Today to Reach Your Goals Tomorrow

Request a demo today to see how Buynomics supports your RGM team and helps you make data-driven decisions.

October 26, 2022